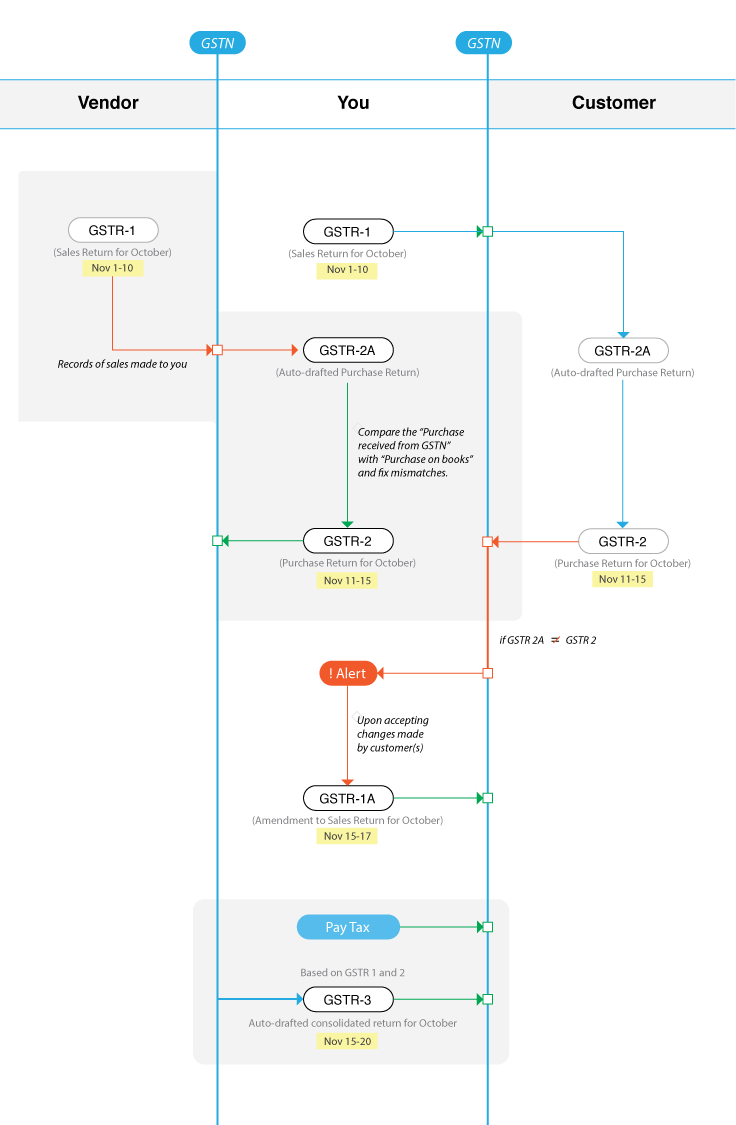

Every registered taxpayer under GST who is not under a special scheme (like the composition scheme or an ISD registration) is required to file three tax statements each month called GSTR-1 (for sales), GSTR-2 (for purchases) and GSTR-3 (consolidated). While the GSTR-1 needs to be drafted by you, you can literally auto-generate your GSTR-2 and GSTR-3 using the data submitted by your vendors and customers on the GSTN. Here’s how it works:

Sales return

- You: File GSTR-1 between 1st and 10th of the following month. Your sales data from GSTR-1 will populate the GSTR-2A of your customer.

- Customer:

- If your sales records match with their purchase records, they can just accept their GSTR-2A and file GSTR-2 (for purchases).

- Mismatches can be corrected by them before they file GSTR-2 and whenever this happens, the GSTN sends you an alert.

- You: Cross-verify changes made by your customer and file the GSTR-1A before 17th of the following month to make necessary corrections to your GSTR-1.

Purchase return

- Vendor: Files GSTR-1 into the GSTN and this data populates your GSTR-2A form.

- You: Verify data on your GSTR-2A and make corrections, if needed before filing your purchase data in the form of GSTR-2 between 11th and 15th of the following month.

Consolidated return

- You: Pay the tax you owe to the government based on your tax liability before filing GSTR-3 between 15th and 20th of the following month. Learn more about GST returns.