- HOME

- Payroll administration

- Variable pay meaning, example, and calculation

Variable pay meaning, example, and calculation

In the race to hire and retain the right talent, companies worldwide are adopting creative ways to compensate employees. One such method is incentivizing employees who exceed expectations with variable pay. It serves as a powerful tool to foster a performance-driven culture and keep employees motivated.

Incentive programs, such as variable pay, have been shown to boost employee performance by an average of 44%.

Understanding variable pay, its calculations, and implications is crucial for compensating your employees better and making your payroll flawless.

Variable pay meaning

Variable pay is a portion of an employee's cost to company (CTC) that changes based on the individual's or the company's performance. It is paid as a reward for the employee's contribution towards the company's growth.

Unlike a fixed salary, variable pay is directly tied to specific achievements. It is paid when the individual accomplishes certain tasks, meets sales targets, or when the company achieves profitability.

Examples of variable pay

Employers in India offer several types of variable pay to align individual goals with organizational objectives. Here are some of the commonly offered types of variable pay.

Sales commission

This is a performance-linked incentive given to sales representatives based on the volume of the sales deals they close. It is usually paid monthly and calculated as a percentage of the revenue generated from the sales transactions. For example, if an employee closes a deal worth 10 lakh in a month, a percentage of that amount will be added to the employee's salary and paid to them as sales commission.

Performance bonuses

These are one-time payments given to employees every year to reward outstanding performance. They are determined by key performance indicators (KPIs) relevant to the employee's role. Some companies categorize employees based on how well they do their work, and the bonus amount is determined by the performance band the employee falls into. For instance, an employee in band A would receive a higher performance bonus than an employee in band B.

In addition to performance bonuses, companies also offer other bonuses, including hiring bonuses, referral bonuses, and statutory bonuses.

Profit sharing plan

A profit sharing plan distributes a portion of the company's profits among its employees, allowing them to share in the organization's financial success.

Typically, companies calculate annual earnings at the end of the fiscal year and allocate a portion of their profits to the employees' sharing pool. From that, individual payouts are calculated and disbursed based on employee performance, salary, and tenure.

ESOP

Employee stock option plans (ESOP) are often seen as forms of variable pay that provide employees with stakes in the company. Many publicly listed companies allow their employees to purchase company stock at a discounted rate within a specified period.

These shares are included as part of the CTC and can serve as long-term incentives to drive performance and loyalty.

Variable pay calculation

The calculation of variable pay varies depending on the organization's policies and the nature of the performance metrics. Let's understand how it generally works with an example.

Assume Piyush and Tejas work as sales representatives for a company and their monthly fixed pays are ₹ 50,000 and ₹ 60,000. They receive an additional commission of 10% of the total revenue generated through their sales. Suppose both execute sales worth ₹ 80,000 and ₹ 100,000, their salary breakdown will be as follows:

| Piyush | Tejas | |

| Monthly fixed pay | ₹ 50,000 | ₹ 60,000 |

| Sales achieved | ₹ 80,000 | ₹ 100,000 |

| Sales commission earned | ₹ 8,000 | ₹ 10,000 |

| Total salary (fixed pay + commission) | ₹ 58,000 | ₹ 70,000 |

💡 Offer higher commission percentages to encourage employees to win larger deals. For example, grant an extra 5% commission on sales exceeding 5 lakh.

Is variable pay taxable?

Yes, variable pay is subject to taxation in India. It is treated as part of the employee's total income and is fully taxed under the Income Tax Act, 1961.

Here's what you need to do while calculating tax on variable pay:

- Net taxable income: Add variable pay to the employee's salary, allowances, and other sources of income to determine the employee's taxable income.

- Tax deduction at source (TDS): Deduct tax at source on variable pay at the time of payment to the employees. The TDS rates for variable pay are the same as those for regular salary income, and the rate depends on the employee's income and the income tax slab set by the government.

- Form 16: Give employees with Form 16 a breakdown of their salaries and TDS deducted on variable pay and other salary components. Employees will use this form to file their income tax returns.

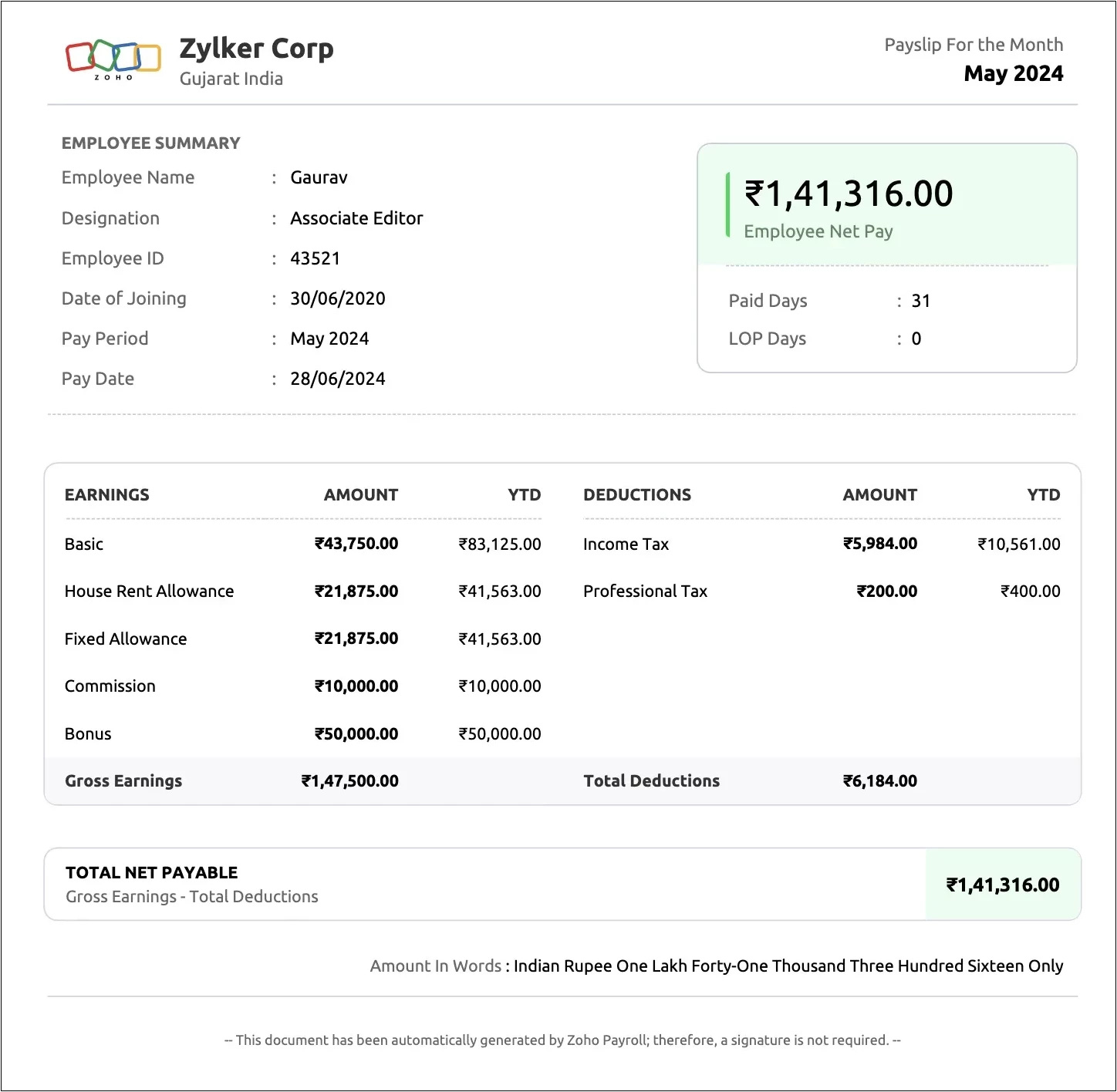

Variable pay in salary slip

Once you calculate and settle variable pay along with your employees' salaries, be sure you also generate comprehensive salary slips.

Salary slips with clearly labeled variable pay components help your employees better understand how they're being compensated for their work. Remember to also present how each component is taxed in the payslip.

Sample salary slip with commission and bonus as variable pay components

Fixed pay vs. variable pay

Fixed pay and variable pay serve different purposes in employees' compensation. While fixed pay provides employees with a stable income regardless of their performance, variable pay incentivizes high performance.

| Fixed pay | Variable pay | |

| Definition | A predetermined, fixed amount regularly paid to an employee, usually on a monthly basis. | A salary component that fluctuates based on an individual or organization's performance. |

| Calculation | Calculated by dividing annual salary with the total number of pay periods (for example, 12 months). | Calculated based on performance metrics such as sales revenue generated, project completion rate, or individual ratings. |

| Taxability | Subject to taxation under the Income Tax Act. Certain components of it are exempt from tax, subject to the limits set by the government. | Considered as part of the employee's taxable income and is taxed fully. |

| Examples | Basic pay, house rent allowance, and conveyance allowance. | Sales commission, profit sharing plan, and employees stock options. |

Frequently asked questions

Is it mandatory to offer variable pay?

No, employers in India are not required by labour laws to provide variable pay. They have the flexibility to design their employees' CTC according to their business needs, industry standards, and employee retention strategies.

Does CTC include variable pay?

Yes, the cost to company includes both fixed and variable components of a salary. CTC represents the total cost incurred by the employer for an employee, including basic pay, allowances, bonuses, commissions, and benefits.

What does annual variable pay and current variable pay mean?

Annual variable pay is performance-based compensation provided to employees once a year, like the company's profit sharing plan. Current variable pay refers to the incentives currently applicable to the employee's role, such as their sales commission for a particular month.