Sub Accounts

What are Sub Accounts?

Sub-accounts are child accounts created under a parent account. It helps to track the income and expense(s) of the parent account effectively.

When do I use Sub Accounts?

Let’s say you want to track all your travel expenses. You can create sub accounts under the Travel Expense account in Zoho Books. You can name the sub-accounts Lodging, Tickets, Cab charges, etc. The creation of sub-accounts also helps you to view certain reports in detail through drill down of the Report.

Few other scenarios are described below where sub-accounts are beneficial to precisely track the income or expense.

Scenario 1

You maintain an expense account for all the insurance amount you pay and wish to track all the insurance payments individually. You can create an Expense account called Insurance under Expenses. You can further create sub-accounts such as Property Insurance, Automobile Insurance, Other Insurances, etc. under the parent account to track the amount paid for each Insurance.

Scenario 2

You have a business and there are several ways in which you earn income. You can create an account called Income and further create sub–accounts under the Income account and name them Sales Revenue, Interest Received, Rentals Received, Other Income, etc. This helps you to track your Income in detail.

Scenario 3

You have a book shop and wish to track the cost for different genres of books that are sold. You can create sub-accounts under Cost of Goods Sold and name them Fiction, Comedy, Drama, Horror, Romance, etc. This helps you to track the costs of the books sold according to genres.

In this page, you will learn about:

Creating Sub Accounts

You can create sub-accounts under a parent account either from Chart of Accounts or directly from certain other modules in Zoho Books.

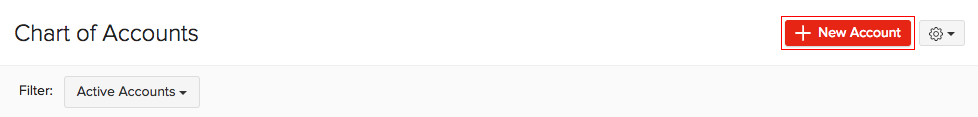

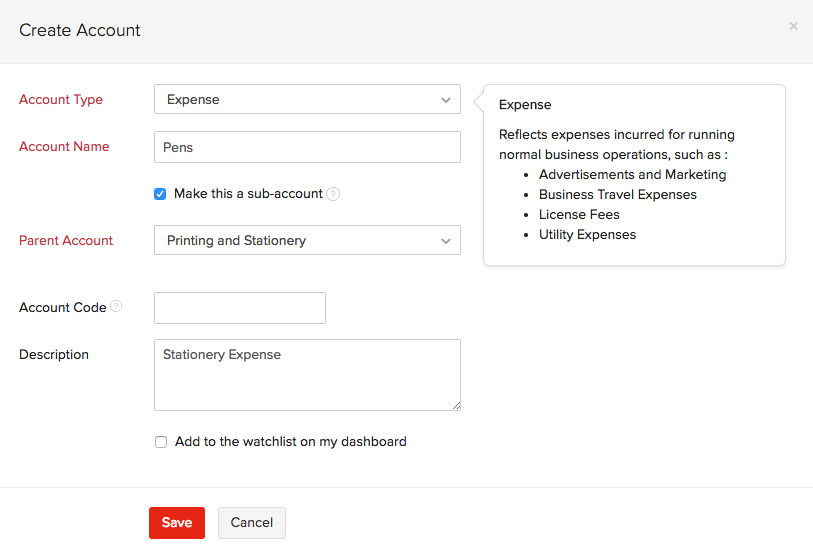

To create a sub-account from the Chart of Accounts:

- Go to the Accountant module on the left sidebar.

- Select Chart of Accounts.

- Click the + New Account in the top right corner of the page.

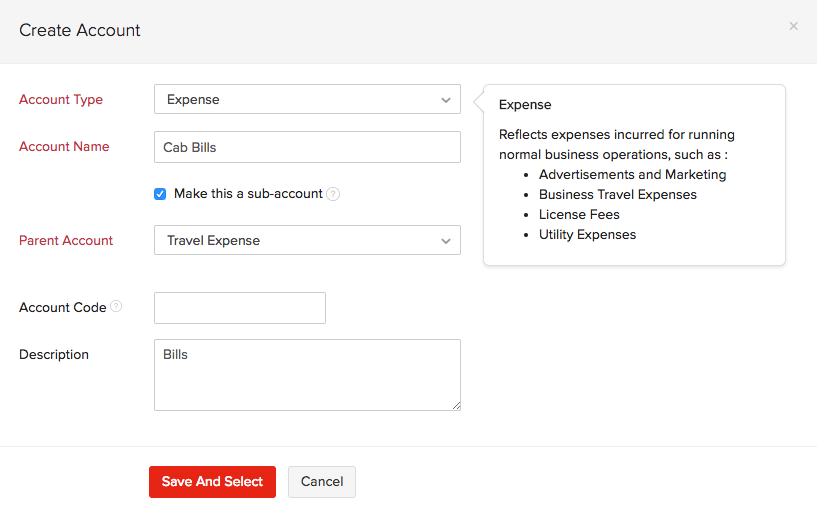

- Fill in the Create Account page and check the box Make this a sub-account.

- Click Save.

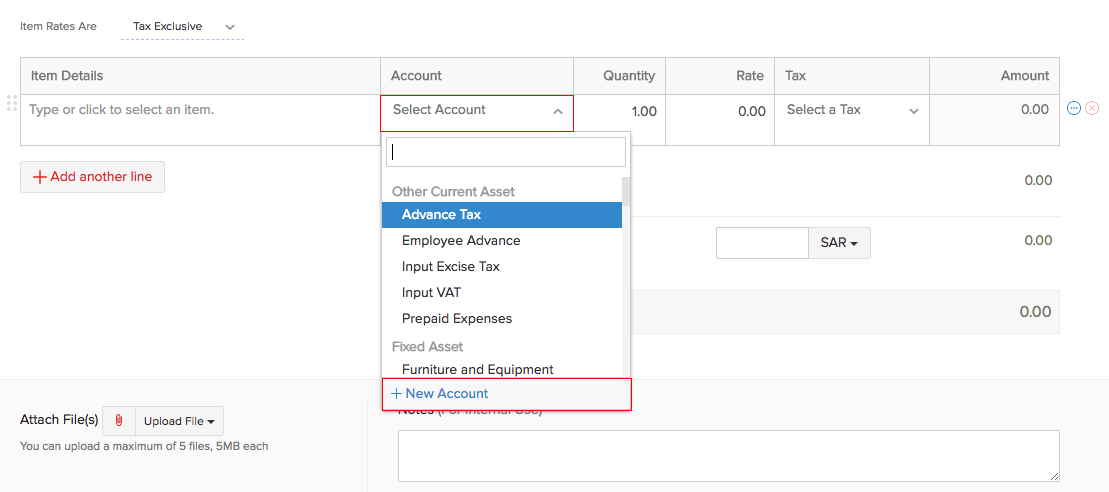

You can even create sub-accounts on the go in certain modules. For example, to create sub accounts in Bills:

- Go to the Purchases module on the left sidebar.

- Select Bills.

- Click the + New button in the top right corner of the page.

- Click the Select Account drop down menu under Item Details.

- Select + New Account.

- Click Save and Select.

Similarly, you can create sub-accounts directly from modules like Items, Credit Notes, Expenses, Recurring Expenses, Purchase Orders, Bills, Recurring Bills and Vendor Credits.

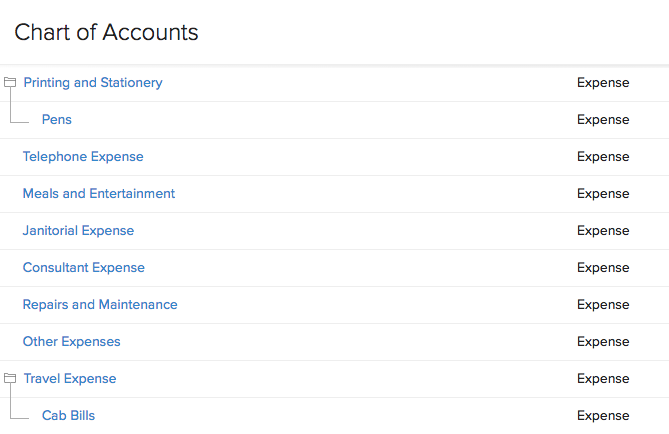

The newly created sub-accounts will be listed under the parent account in the Chart of Accounts.

Note:

You can create only five sub-accounts under a sub-account. However, you can create multiple sub-accounts under a parent account.

Currently, you can create sub-accounts under all the following Account Types:

- Other Asset

- Other Current Asset

- Cash

- Fixed Asset

- Stock

- Other Current Liability

- Long Term Liability

- Other Liability

- Equity

- Income

- Other Income

- Expense

- Cost of Goods Sold

- Other Expense

Reports for Sub-Accounts

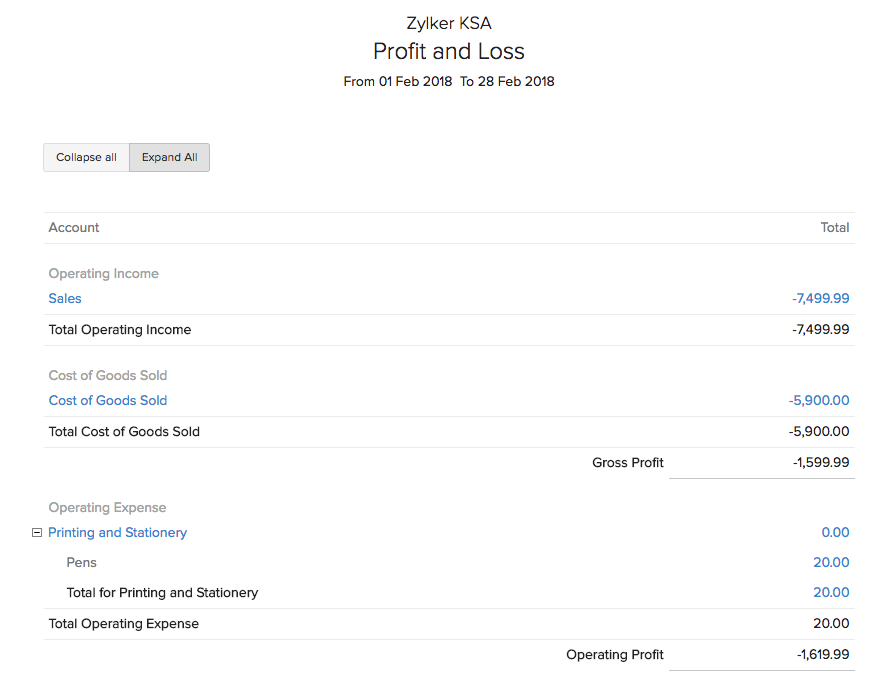

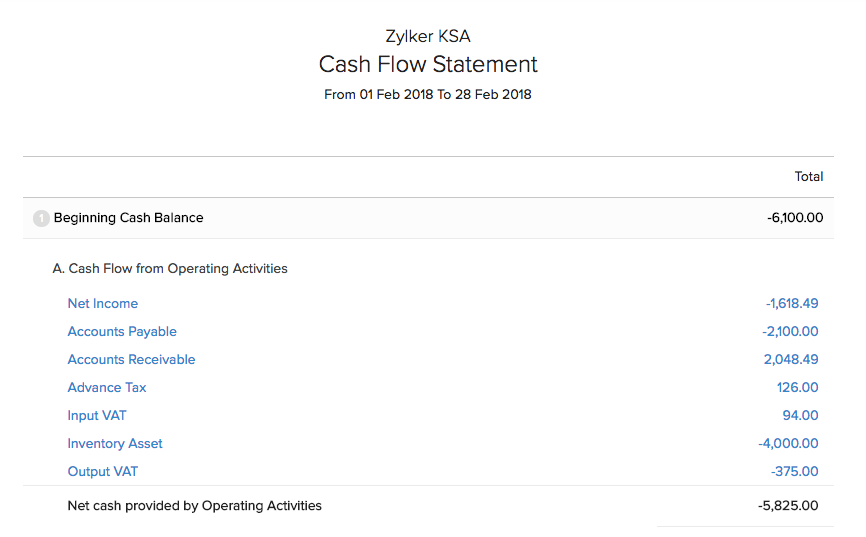

The changes in credit and debit of the sub-accounts will be directly reflected in the Profit and Loss Report, Cash Flow Statement, Balance Sheet, Trial Balance and General Ledger.

Zoho Books allows you to view the reports either in Collapsed view or Expanded view. Collapsed view displays the parent accounts while the Expanded view displays a drill down report along with the sub-accounts.

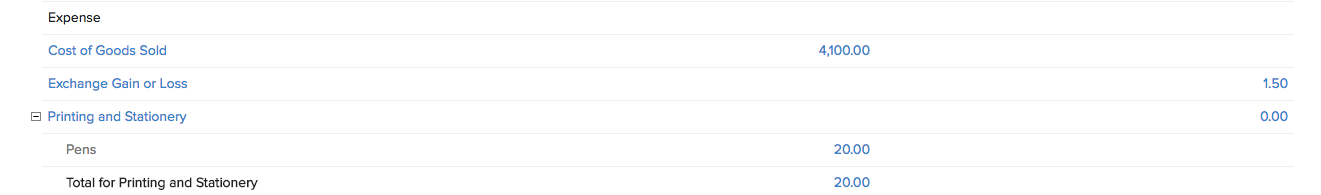

Profit and Loss

To view the effect of sub accounts in the Profit and Loss report:

- Go to the Reports module on the left sidebar.

- Select Profit and Loss under Business Overview.

Click Collapse All to see only the parent accounts.

Cash Flow Statement

To view the effect of sub accounts in the Cash Flow Statement report:

- Go to the Reports module on the left sidebar.

- Select Cash Flow Statement under Business Overview.

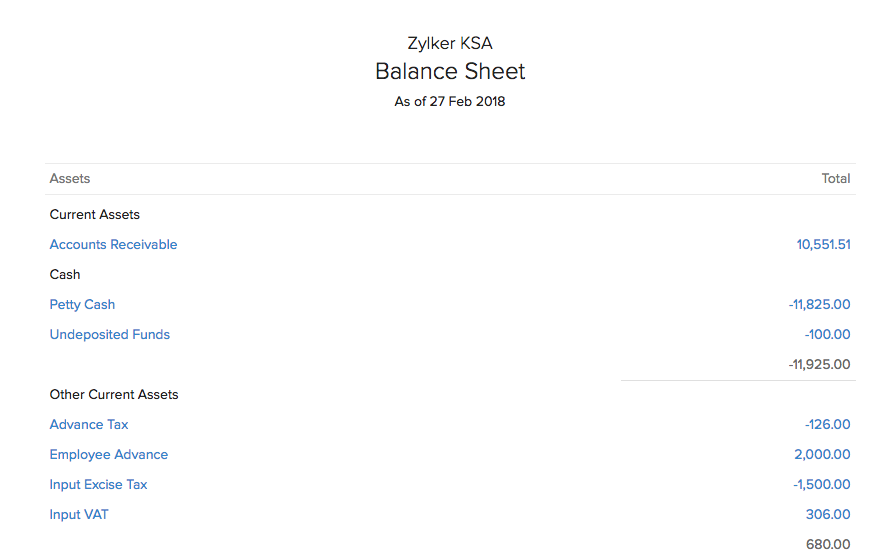

Balance Sheet

To view the effect of sub accounts in the Balance Sheet report:

- Go to the Reports module on the left sidebar.

- Select Balance Sheet under Business Overview.

General Ledger

To view the effect of sub accounts in the General Ledger report:

- Go to the Reports module on the left sidebar.

- Select General Ledger under Accountant.

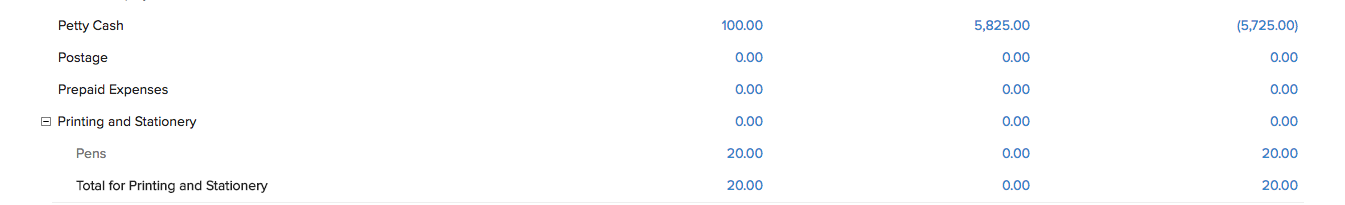

Trial Balance

To view the effect of sub accounts in the Trial Balance report:

- Go to the Reports module on the left sidebar.

- Select Trial Balance under Accountant.

Yes

Yes

Thank you for your feedback!

Thank you for your feedback!