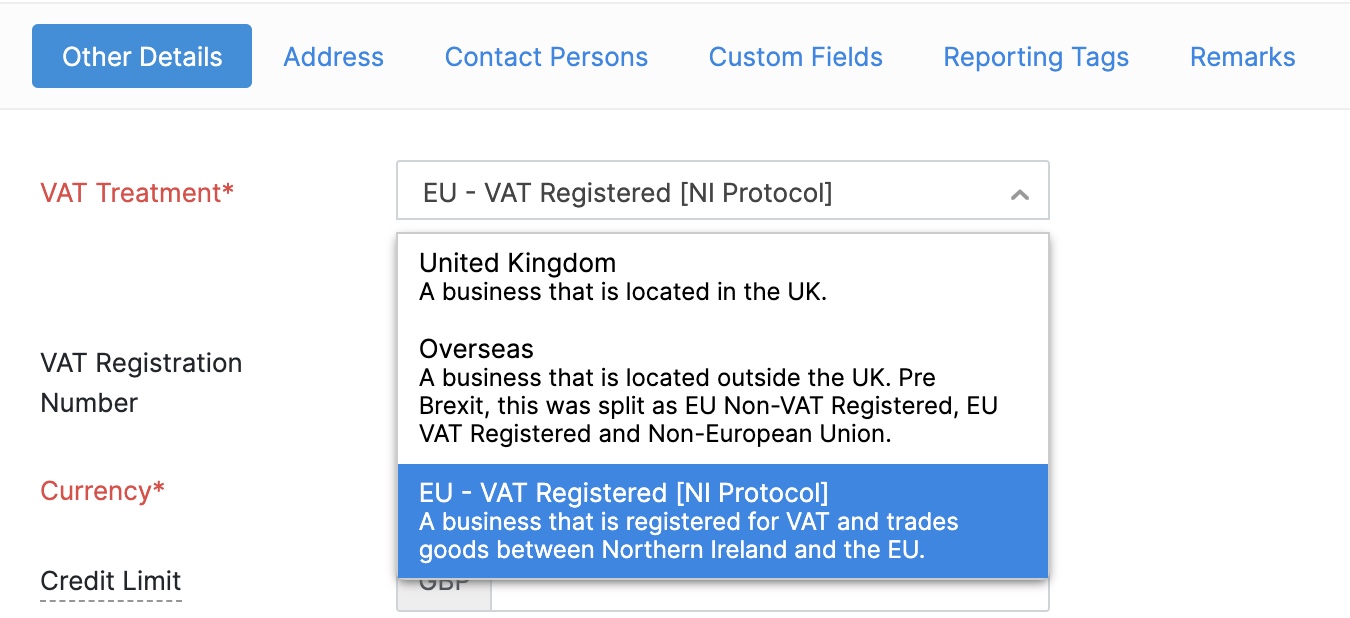

When you are trading goods between Northern Ireland and the EU, NI protocol will be applicable to those transactions. In Zoho Books, you will have to enable the NI protocol in VAT settings to use EU VAT Registered [NI Protocol] as the VAT Treatment for transactions and contacts. Here’s how:

Once you have enabled the settings, the EU VAT Registered [NI Protocol] treatment will be displayed under the VAT Treatment field in contacts and in transactions for trading goods between Northern Ireland and the EU.

Also, by default, the VAT Registration Number will be updated to XI in transactions that have their VAT Treatment as EU - VAT Registered [NI Protocol].

Books

MTD ready accounting

software for small

businesses.