VAT software for accounting & online return filing

Make VAT compliance convenient. Zoho Books calculates the tax you owe, creates VAT reports, and tracks the VAT you've paid and reclaimed with HMRC.

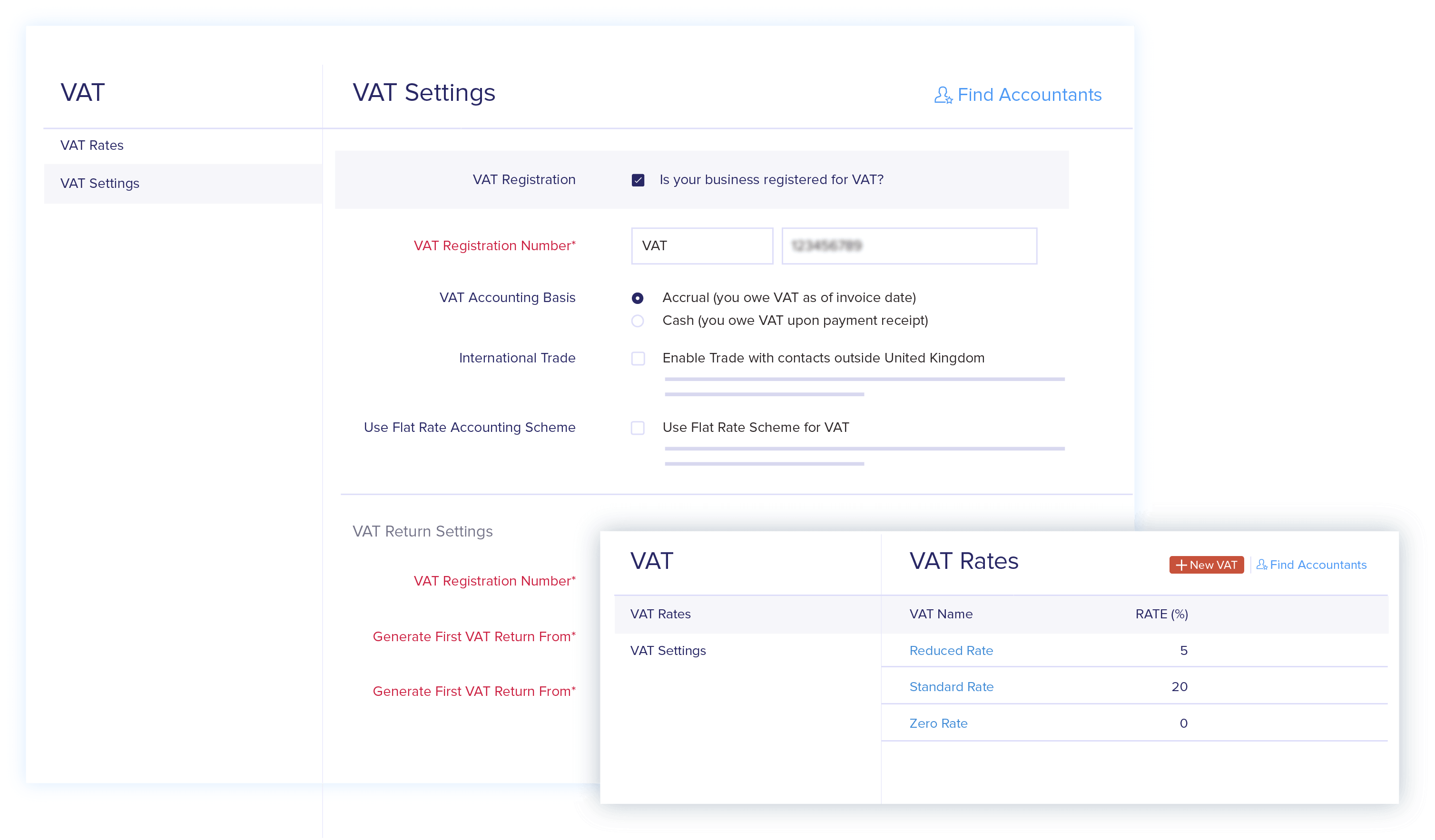

Set up your taxes before you start selling

Have your taxes in place before you take your first order. Define multiple taxes, set a default tax rate, and enter the exemptions that apply to your business.

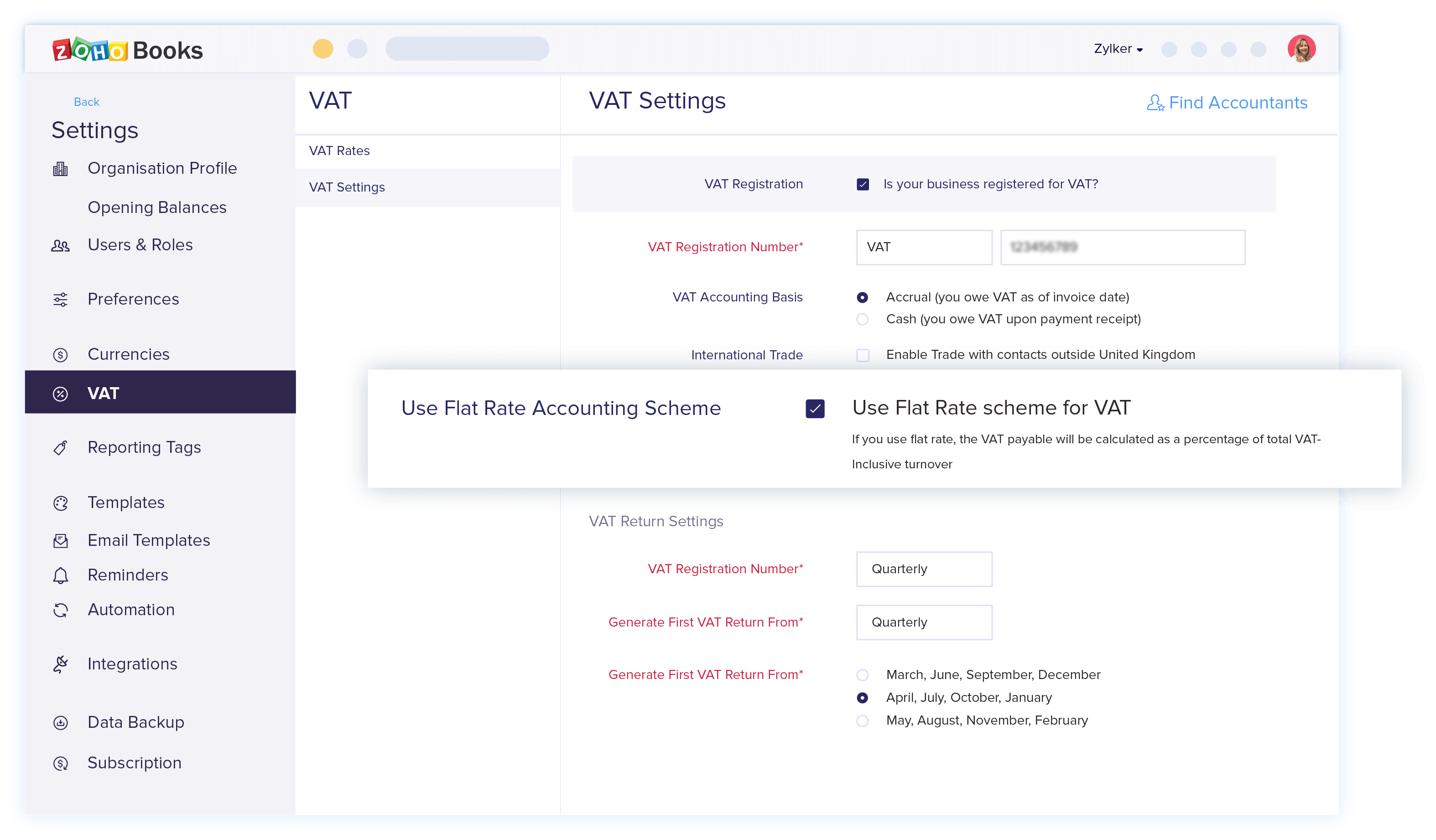

Enable the flat rate scheme

If your business falls under the VAT Flat Rate Scheme, enable the Flat Rate option under your VAT settings and let Zoho Books take it from there.

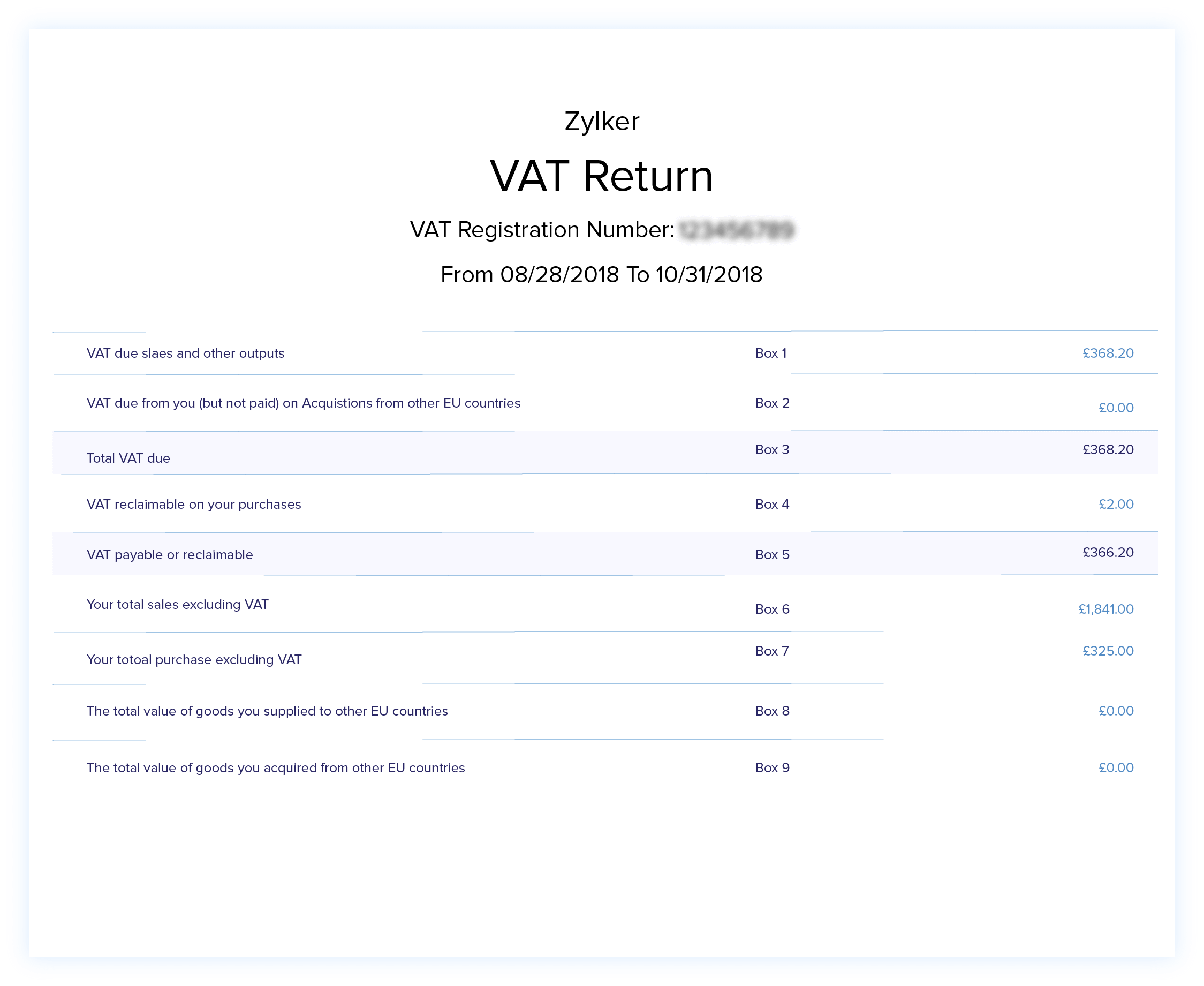

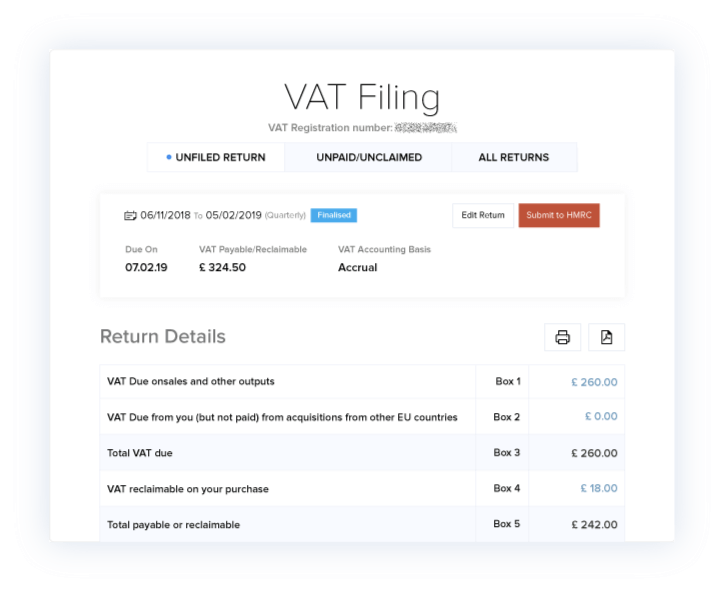

Find your VAT liability

Zoho Books simplifies the process of filing and recording your VAT returns with powerful reporting tools. We calculate the VAT you owe and the amount you can reclaim in a consolidated report that's ready to file at tax time.

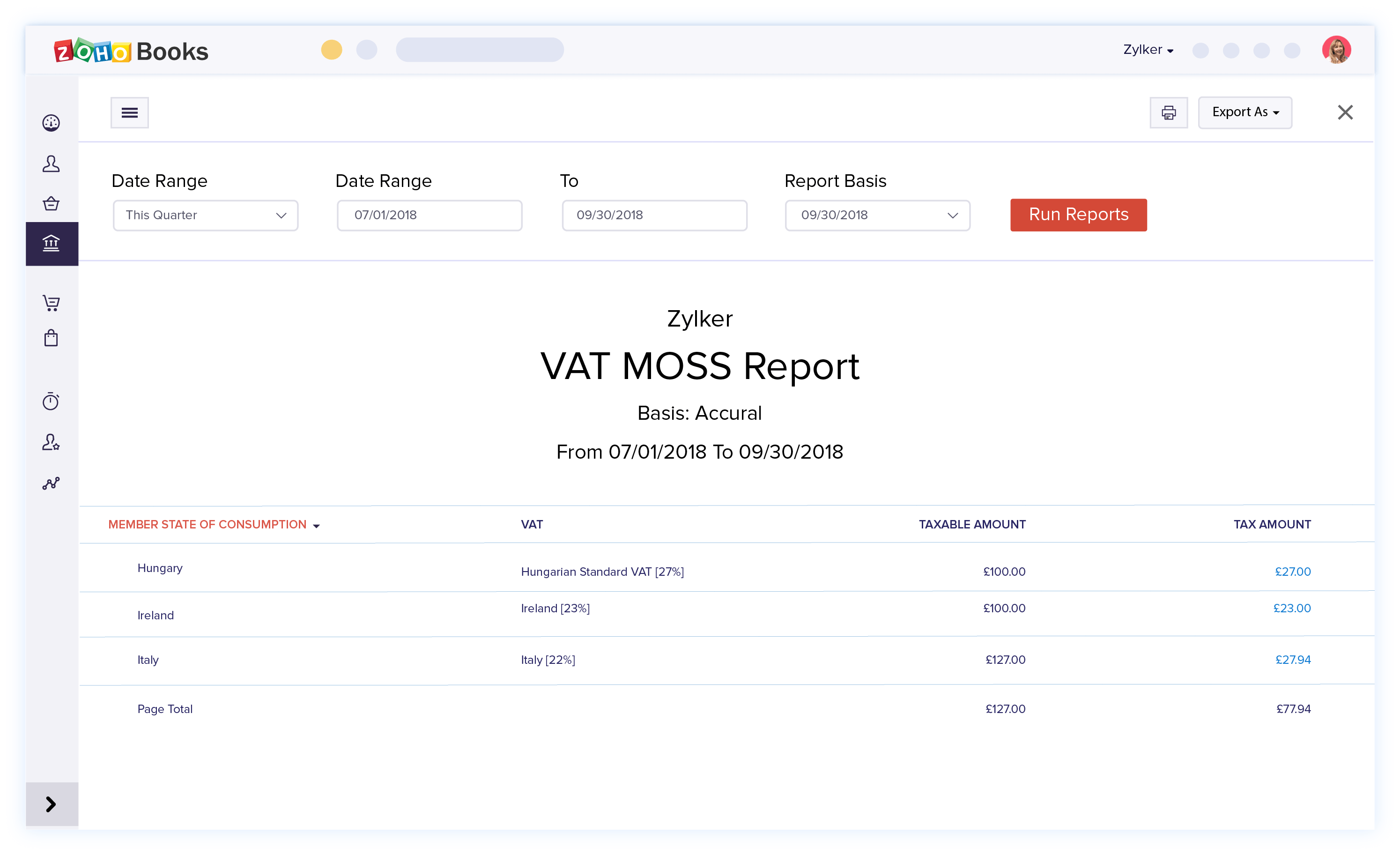

Keep track of your digital service supplies

The moment you send a sales transaction for digital services to your customer, Zoho Books records it all in the MOSS Report, including details of the countries you sold to and the tax that you need to pay.

File returns directly

Zoho Books generates your VAT returns based on your purchases and sales, allowing you to review, finalise and directly submit them to HMRC.

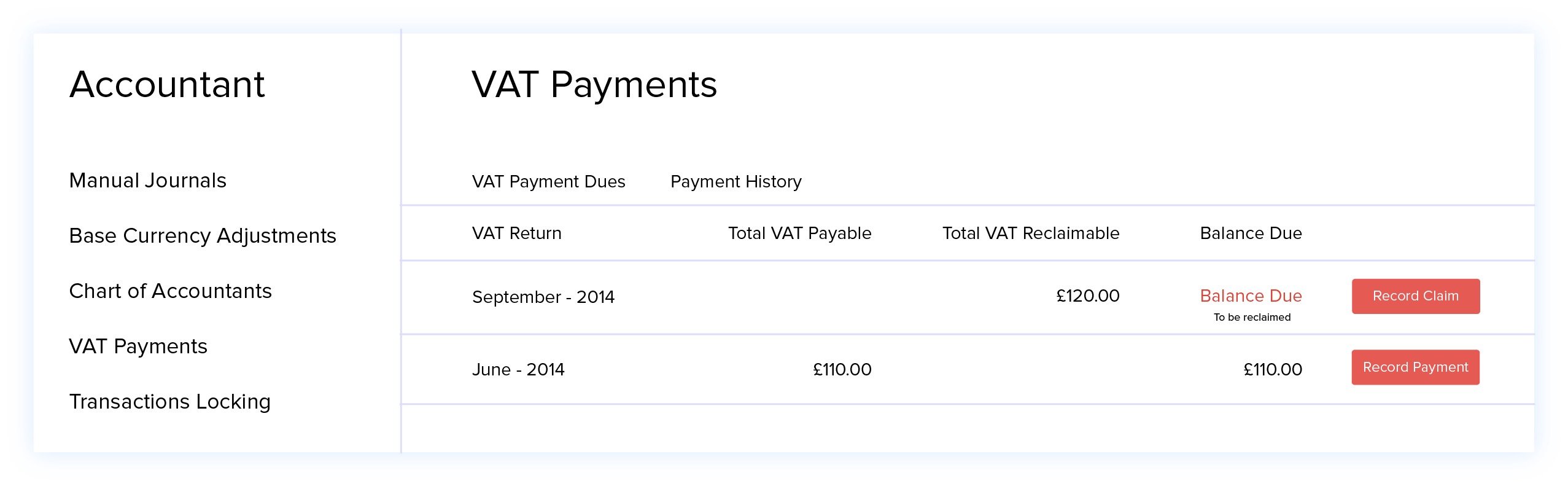

Record your VAT payments

Stay on top of your tax payments and reclaims. Zoho Books helps you record the payments you have made and the reclaims you have received, and you can always track them under your Payment History section.