Insights

Note: This feature is available only for clients whose Client Type is Zoho Client. This is because your client profile must be linked with an organization in any of the available Zoho Finance applications to facilitate access to business insights.

Keeping track of your clients' business data is one of the core necessities of accounting services. This will help you provide top-notch services to your clients. Moreover, analysing your clients' business data helps you tailor your services to each client’s specific needs and financial situation.

With insights into a client’s financial data, your accounting firm can offer proactive advice, such as tax-saving strategies or financial planning. Thus, helping clients make informed decisions.

Insights in Zoho Practice help you do just that! The Insights module is a dashboard that displays an overview of your client’s financial data from their associated organizations in Zoho Finance applications. Insights display important metrics to keep track of in your client’s organization. These include the organization’s Aged Receivables, Aged Payables, Cash Flow Analysis, pending book reviews and more. In addition to this, you can also find alerts of the organization’s finances such as anomalies in the general ledger and more.

Let’s take a look at each of these sections.

Note: Only users who’ve been assigned to a client, or users with the required permissions such as admin users who have Full Access permissions will be able to view the insights of their assigned client.

Overview of Client’s Organization’s Finances

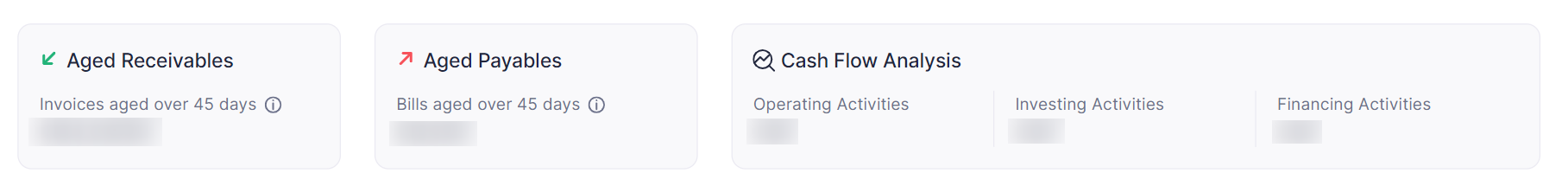

You can view important financial metrics of your client’s organization at the top of the Insights dashboard.

Aged Receivables

This section shows the total amount that your client’s customers owe them that are 45 days past their due date. You can view the aged receivables in more detail in your client organization. Here’s how:

- Go to the Insights module from the sidebar.

- Select the required client’s organization from the client insights dropdown at the top.

- Click the Aged Receivables section.

- You will now be directed to the AR Aging Details By Invoice Due Date report in your client’s organization. This will open in a new tab.

You can view details of the related transactions in this report, and view each of the invoices, customers or transactions by clicking the relevant rows in the report.

Aged Payables

This section shows the total amount that your client owes their vendors that are 45 days past their due date.

Cash Flow Analysis

Cash flow is a critical element of a company’s financial management because it highlights the funds available for covering expenses and investments—essentially, the money required to sustain and expand the business.

In this section, you can view the crucial elements related to the cash flow of your client’s organization.

Operating Activities: These activities show the amount spent in the company’s core day-to-day operations, like sales and expenses.

Investing Activities: This category includes the amount spent on buying and selling assets like equipment or investments. By looking at investing activities, you can assess how much cash is used for long-term investments or acquisitions.

Financing Activities: Financing activities involve transactions related to borrowing or repaying loans, as well as issuing or buying back shares.

You can click the Cash Flow Analysis section to view the report of the cash flow statement of your client’s organization. This will open in a new tab.

Monitoring cash flow is vital as it provides a real-time snapshot of a company’s financial health. You can use cash flow analysis to asses whether a business can meet its immediate financial obligations. Based on this you can make informed decisions, manage debt, and maintain compliance.

Clean Up

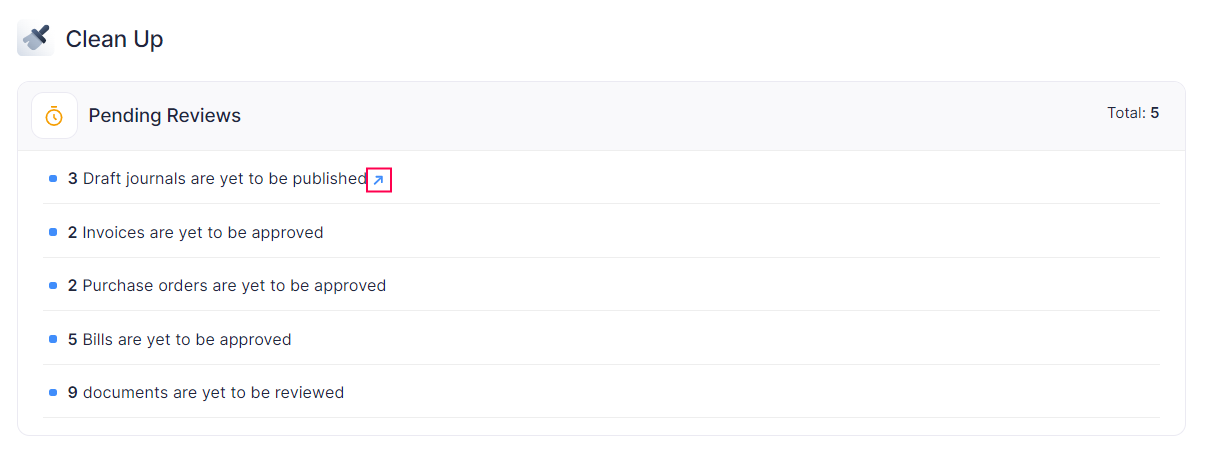

Pending Reviews

Organizations might have finances and financial statements by way of transaction PDFs, documents, unused credits and more that are unaccounted. During the process of a book review or a full audit, it is imperative that each of the documents, and any finance is accounted for.

The Pending Reviews section helps you keep track of all such documents at a glance. The documents, statements, credits or any entity that are unaccounted for will be displayed here.

You can click on any of the lines to go to the client’s organization and review and decide the next course of action related to the entity.

Scenario: Patricia, a professional at Zylker Accounting, was tasked with conducting the annual financial audit for one of their esteemed clients, Loyal Co. Leveraging the Pending Reviews section within the Insights module of Zoho Books, she accessed the documents that needed review in her client’s organization. So, she simply went into Loyal Co.’s Zoho Books account, reviewed the transactions, and made sure everything was in order. Now, Loyal Co. is all set for their annual audit.

Bank Transactions

In this section, you will be able to view insights about a client’s disconnected bank feeds, uncategorized, duplicate and unreconciled transactions.

Note: You will be able to view these specific insights only if your clients have connected their bank feeds in their Zoho Books organization, and if the Banking module is in use by your client’s organization.

| Field | Description |

|---|---|

| Disconnected Bank Feeds | Bank feeds that are no longer actively connected to your client’s Zoho Books organization are shown here. |

| Uncategorized Transactions | Transactions that haven’t been assigned to specific categories in accounting records. Insight: If you’re in doubt about specific transactions, you can select them create a client request to request more information about the transactions from your client. The client request will be automatically generated with a questionnaire requesting additional details. You can edit this from the client request’s details page. |

| Unreconciled Transactions | Financial transactions that have not been matched or balanced in accounting records. This might lead to incomplete financial reconciliation. |

| Duplicate Transactions | This displays transactions that have been recorded more than once which might result in inaccurate accounting. |

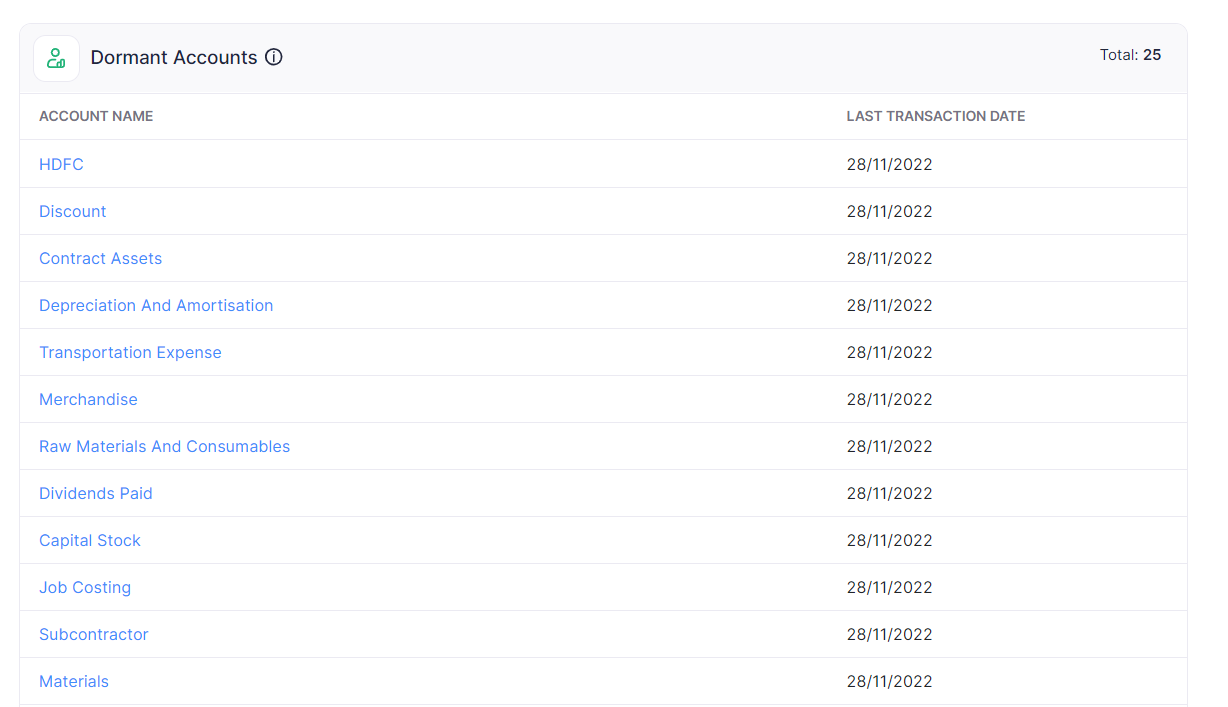

Dormant Accounts

In this section, you can view the accounts in which no transactions have been recorded in the past 90 days. You can click on any of the accounts to visit the Chart of Accounts module in your client’s organization.

When a significant portion of an organization’s accounts remains inactive or unused for an extended period, it can signal potential issues within the organization’s financial management. By accessing this information at a glance, you can review the organization’s accounts and suggest appropriate financial advice.

Insights

Average Debtor Age

This is the average time (in days) it takes for customers to pay their unpaid invoices. This metric provides insights into how quickly your clients are getting paid. A shorter average age is good news, indicating prompt payments and a healthy cash flow. On the flip side, a longer average debtor age may raise concerns about late payments and cash flow challenges.

General Ledger

The general ledger records every financial transaction, from sales and expenses, and loans to payments of a business. In this section, you will be able to view all any anomalies in the general ledger. This includes any unexpected increases or decreases in the general ledger.

In such an instance, the details of the increase or decrease will be mentioned here. You can then review this and mark it as verified. This way, you can keep a close eye on all the finances of your client’s organization.

Here’s how you review alerts:

- Click the specific alert to review it’s details. This will open in a new tab and take you to the client’s Zoho Books organization.

- Hover over a specific alert.

- Click the verify icon that appears.

- Enter the reason for the anomaly after you’ve thoroughly reviewed the alert. This helps in maintaining accurate records.

- Click Mark as Verified.

Relative Size Factor

Relative size factor within a single business refers to the comparison of financial data over time. This helps identify trends in a company’s financial performance. In this section, the customers of your clients with a RSF of more than 4 will be displayed.

Top Expenses

In this section, you can view the top 5 expenses of your client’s organization. This information is essential as it provides a clear picture of where or how the organization is spending most of it’s finances. You can then review this information and suggest measures to your clients for effective cost control, budgeting, or financial analysis.